New data could pave the way for the Federal Reserve to cut interest rates as Wall Street braces for the impact of tariff hikes from the White House, said CNBC’s Jim Cramer as he analyzed Wednesday’s market action.

“We’re most likely not going to go into a serious recession, because the Fed can take action to prevent that,” he said. “And even if the Fed does nothing, the market can recover once all of this tariff stuff is behind us — and it will be behind us at some point.”

February’s consumer price index — which measures wide-ranging costs of goods and services across the country — ticked up 0.2%, slightly less than expected. Subsequently, the Nasdaq Composite rose 1.22% and the S&P 500 inched up 0.49%, while the Dow Jones Industrial Average lost 0.2% as investors reacted to cooler-than-expected inflation data.

Lower rates can stimulate the economy, and Cramer said the data in the CPI report gives the Fed room to cut, which would benefit the market as a whole. The central bank may actually have to cut, he continued, because tariff increases could lead consumers to spend less, which in turn means many retailers will miss their estimates.

Cramer said he knows “we’re not out of the tariff woods.” While he understands President Donald Trump’s goal of better trade deals with other countries, he said the heavy-handed policies have caused a “ridiculous amount of angst.” Cramer suggested that many on Wall Street believed Trump would be a champion of American business, but now it seems that only Tesla CEO Elon Musk is “is having any fun,” while others are scared and not spending.

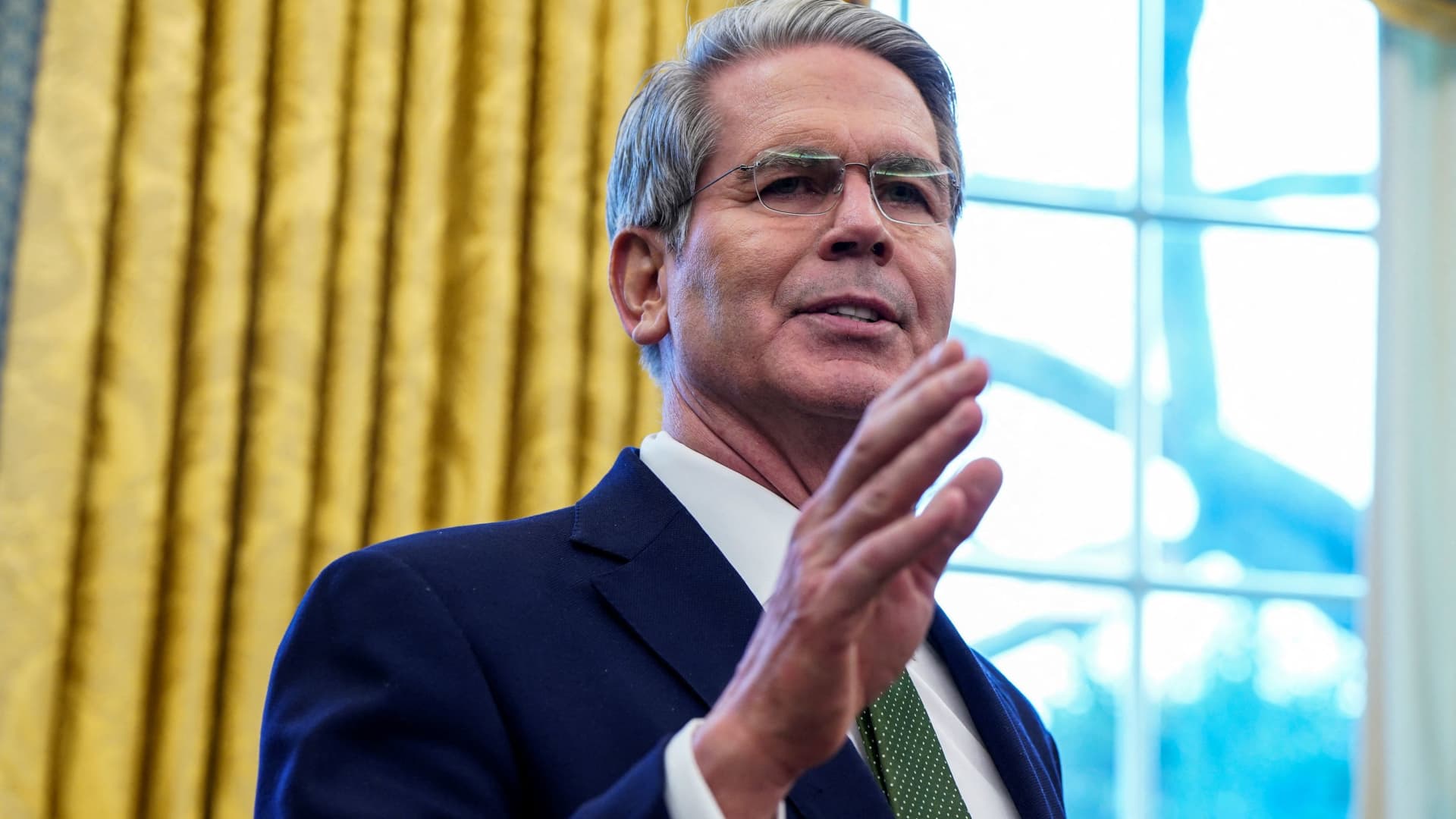

“In the end, we’ll probably need Fed Chief Jay Powell to save us, even as that’s probably the last thing he wants to do,” Cramer said.

The White House did not immediately respond to request for comment.