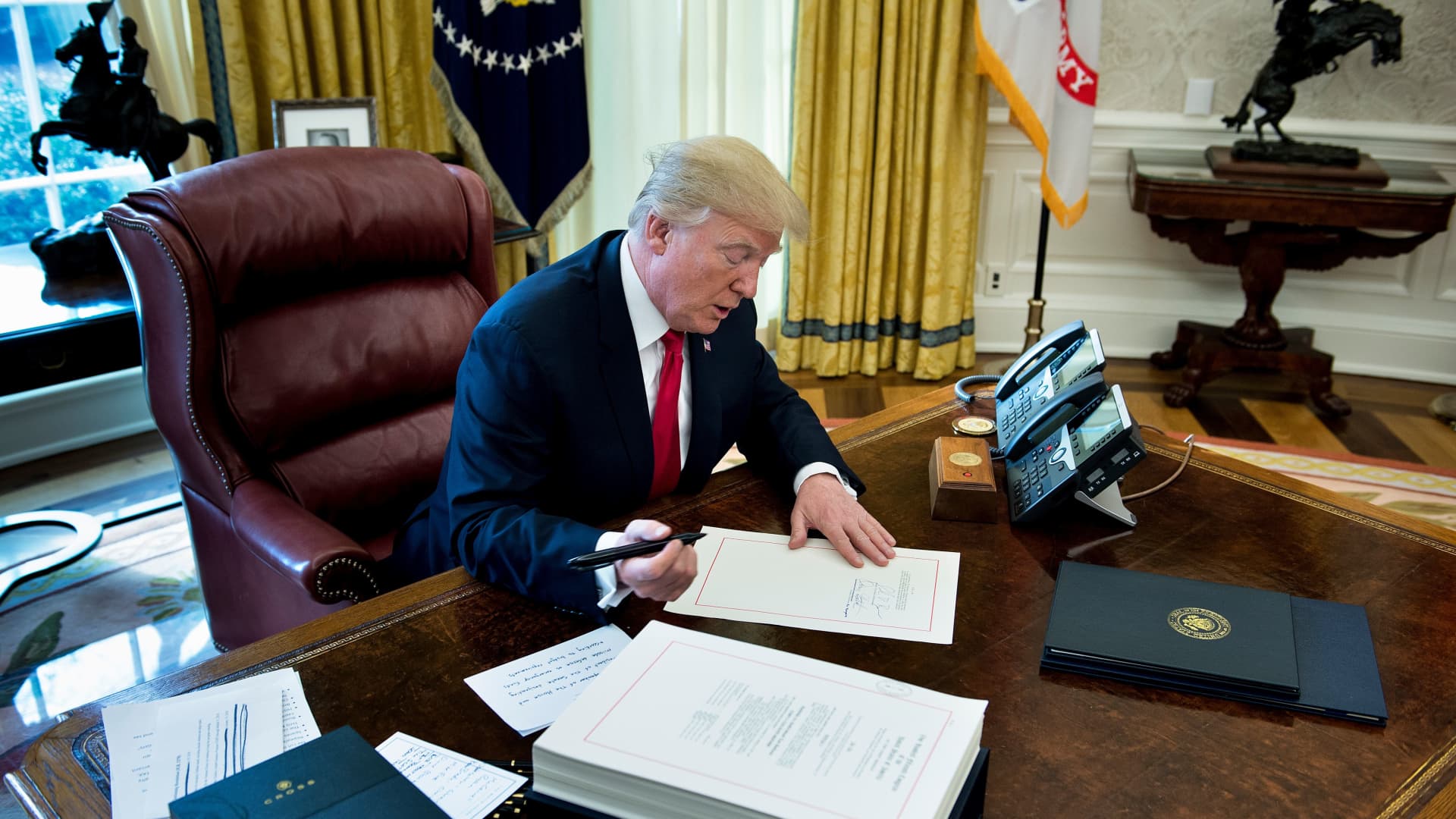

President Donald J. Trump signs the Tax Cut and Reform Bill in the Oval Office at The White House in Washington, DC on December 22, 2017.

Brendan Smialowski | AFP via Getty Images

There’s tax uncertainty heading into 2025 as Congress prepares to negotiate President-elect Donald Trump’s economic agenda.

But there could be lessons for investors from his signature tax overhaul in 2017, financial experts say.

During his campaign, Trump vowed to fully extend the trillions in tax breaks he enacted via the Tax Cuts and Jobs Act, or TCJA, in 2017, which brought sweeping changes for individuals and businesses.

He also called for new policies, like no tax on tips, ending taxes on Social Security benefits for older adults and eliminating the $10,000 cap on the deduction for state and local taxes, known as SALT, among others.

More from Personal Finance:

These key 401(k) plan changes are coming in 2025. What savers need to know

More colleges will close in the next 5 years amid ‘unprecedented’ challenges

Here’s the inflation breakdown for November 2024 — in one chart

While Republicans largely back Trump’s agenda, no one knows which proposals will prevail, particularly amid concerns over the federal budget deficit. That makes planning for tax changes more challenging.

Still, there are things to learn from Trump’s 2017 tax package, experts say.

Last-minute tax strategies

Without action from Congress, trillions of tax breaks enacted via the TCJA will expire after 2025, including lower tax brackets, bigger standard deductions, a more generous child tax credit and a higher estate and gift tax exemption, among other provisions.

But after securing the trifecta — control of the White House, Senate and House of Representatives — Republican lawmakers plan to address these expirations through a process known as “reconciliation,” which bypasses the filibuster.

Republicans used the same strategy to enact the TCJA in late December 2017.

Before the law’s effective date on Jan. 1, 2018, some investors used last-minute strategies, like “accelerating itemized deductions,” by prepaying property taxes and state income taxes, according to certified public accountant Duncan Campbell, who leads Baker Tilly’s private wealth practice.

The move was popular among top earners in high-tax states, like California, New Jersey and New York. Those individuals would soon be limited to $10,000 federal deduction for SALT, which includes property and state income taxes.

‘Be ready and positioned’ for changes

With several pending tax law provisions, many advisors urge clients to avoid irreversible tax plan changes until final legislation is signed into law.

“My preference is always to go with what we know will be true versus what could be true in the future,” said Ryan Losi, a certified public accountant and executive vice president of CPA firm Piascik.

My preference is always to go with what we know will be true versus what could be true in the future.

Ryan Losi

Executive vice president of Piascik

Over the past year, Losi urged clients above the estate and gift tax exemption to meet with an attorney to discuss plans to reduce taxable estates if Congress doesn’t extend the higher limits after 2025.

In 2025, the basic exclusion amount will rise to $13.99 million per person, which applies to tax-free wealth transfers during life and at death. If it expires, the exclusion will revert to 2017 levels, adjusted for inflation.

“You want to be ready and positioned” to finalize estate planning documents if Congress doesn’t extend the bigger exemptions, he said.

While extending the higher estate tax exemption could be more likely under a Republican-controlled Congress, there were several 11th-hour changes back in 2017.

“There could be another Trump Christmas present that no one expected,” Losi said.

Expect ‘uncertainty’ if legislation passes

Enacted late in December 2017, the TCJA left advisors with little time to analyze changes before Jan. 1, 2018, said Campbell with Baker Tilly.

Plus, “there was a little bit of an uncertainty at that point,” about several newly enacted provisions, he said.

For example, there was confusion about the multi-step calculation for the so-called qualified business income deduction, worth up to 20% of eligible revenue for pass-through businesses, Campbell said.

Tax professionals often have lingering questions after Congress passes legislation. The specifics may be later addressed by IRS guidance.